The practice of Corporate Social Responsibility (CSR) in India is no longer optional; it has become a legal requirement under the Companies Act, 2013. For companies, making a CSR donation involves more than simply providing funds—it requires adherence to a systematic compliance policy. Likewise, NGOs seeking such donations must meet specific eligibility criteria and maintain clear, verifiable records. Understanding the compliance process, required documentation, and qualification requirements for NGOs is essential to ensure donations under CSR are both effective and legally compliant.

Understanding Company’s CSR Compliance in India

In India, company’s donations are also dictated by the Companies Act, 2013 that renders CSR a legal requirement of given businesses. The compliance level with CSR is found in those companies which pass any of the following levels:

- Net worth of ₹500 crore or more

- Turnover of ₹1,000 crore or more

- Net profit in a financial year of 5 crore and above.

Such companies must:

- Spend at least 2% of their average net profits from the last three years on CSR activities.

Ensure that spending aligns with activities listed under Schedule VII, such as:

Key Areas Covered by Schedule VII:

- Eradicating Hunger and Poverty: Activities focused on poverty reduction, improving health and sanitation and providing access to safe drinking water.

- Promoting Education and Skill Development: Including support for special education, vocational skills for children, women, the elderly, and the differently-abled, as well as livelihood enhancement projects.

- Promoting Gender Equality and Women’s Empowerment: Efforts to empowerwomen and reduce inequalities faced by socially and economically backward groups.

- Environmental Sustainability: Initiatives for ecological balance, conservation of natural resources, animal welfare, agroforestry, and protecting flora and fauna.

- Cultural Preservation: Actions to promote and protect art, culture, and the preservation of national heritage.

- Rural Development: Activities aimed at improving rural infrastructure and livelihoods.

- Disaster Management: Contribution to relief, rehabilitation, and reconstruction efforts during natural disasters.

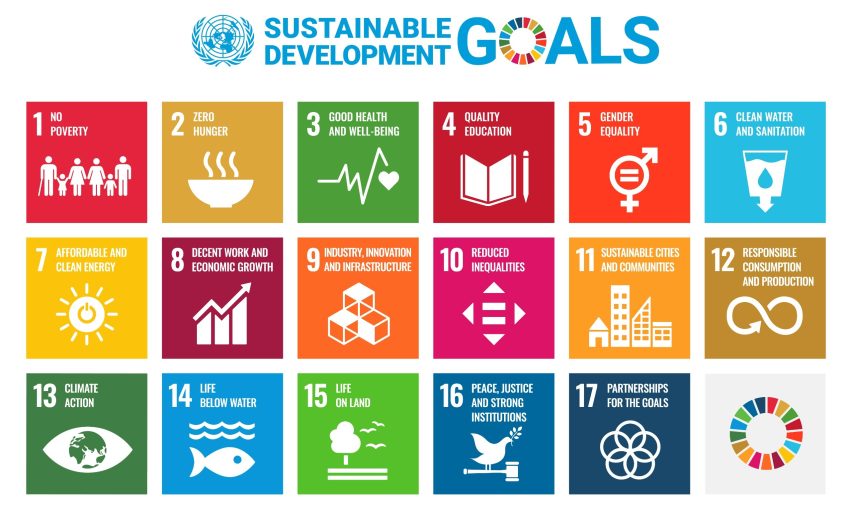

- Support for Research: Contributions to public-funded universities, research institutions, and national laboratories to promote Sustainable Development Goals (SDGs).

- Setting up Social Facilities: Creation of facilities like old age homes, day care centers, and hostels for women and orphans.

Compliance documents that a company requires from NGOs for CSR Donation

To be eligible, an NGO must have the following documents:

- Incorporation under Section 12A

- 80G of the income tax act,

- CSR-1 form

- By laws/ trust deed

- FCRA (for foreign fundraising)

- PAN, and registration details.

- Detailed Project Proposal

- Detailed Budget

These requirements ensure that CSR contributions are directed to organizations with proven capacity, accountability, and compliance with legal provisions.

For NGOs, compliance and accountability are just as important as receiving funds. After receiving CSR donations, an NGO must provide:

- Donation receipts with the NGO’s name,

- Utilization certificates confirming funds were used for the agreed purpose.

- Form 10BE that confirms a donation made to a registered Trust or Institution, which allows the donor to claim a deduction under Section 80G of the tax code.

- Project progress reports (if requested), to help companies evaluate outcomes against proposed objectives.

- Final Impact reports describing how much of the impact is achieved.

These documents not only support the donor company’s compliance process but also build credibility and long-term trust between companies and NGOs.

Conclusion

CSR in India has a defined framework and set of rules of company’s donations, which are beneficial both to the company and NGOs. In the case of companies, CSR compliance guarantees responsible and open distribution of finances. In the case of NGOs, eligibility and delivery of appropriate documentation is important in order to gain and maintain support. When these processes are observed by both parties, CSR donations will be a strong instrument in promoting sustainable development and social challenges in the country.