Corporate Social Responsibility (CSR) has become an essential part of business strategy in India. Companies are expected not only to generate profits but also to contribute meaningfully to social development. However, while planning CSR initiatives, legal compliance must remain a top priority. One of the safest ways to ensure transparency and adherence to regulations is by partnering with an FCRA-approved NGO for CSR funding.

Understanding the Legal Framework

The Foreign Contribution Regulation Act (FCRA) regulates the acceptance and utilization of foreign contributions by individuals, associations, and organizations in India. NGOs that receive international funds must be registered or granted prior permission under this Act. This registration confirms that the organization follows government guidelines related to foreign donations and financial reporting.

By having an NGO approved by FCRA to fund CSR along with a company, a company minimizes the chances of failing to comply with the requirements of the law. Such NGOs are already vetted by authorities and operate within defined legal boundaries.

Ensuring Transparency and Accountability

Conformity is not a mere paperwork, but also credibility. Approved NGOs under FCRA are required to have different bank accounts when receiving foreign contribution, filing of annual returns, and also it is required to disclose financial information in detail. Such a system facilitates accountability and reduces the chances of abuse of funds.

Corporates have the comfort of knowing that their CSR funds are under scrutiny and being appropriately reported by selecting an NGO that has been approved by FCRA. Open accounting helps in enhancing credibility among businesses, beneficiaries and regulators.

Reducing Legal and Reputational Risks

Non-compliance with regulatory laws can lead to penalties, fines, and reputational damage. The firms that work in ignorance with other organizations that do not comply might be inspected when the auditing is done or the government inspects. In extreme situations, the projects can be terminated and the business processes as well as the beneficiaries in the communities would be impacted.

Working with an FCRA-approved NGO for CSR funding acts as protection against such risks. These bodies have to renew their registration after a period of time and remain in line with these shifting legal provisions, so as to remain in line.

Alignment with CSR Mandates

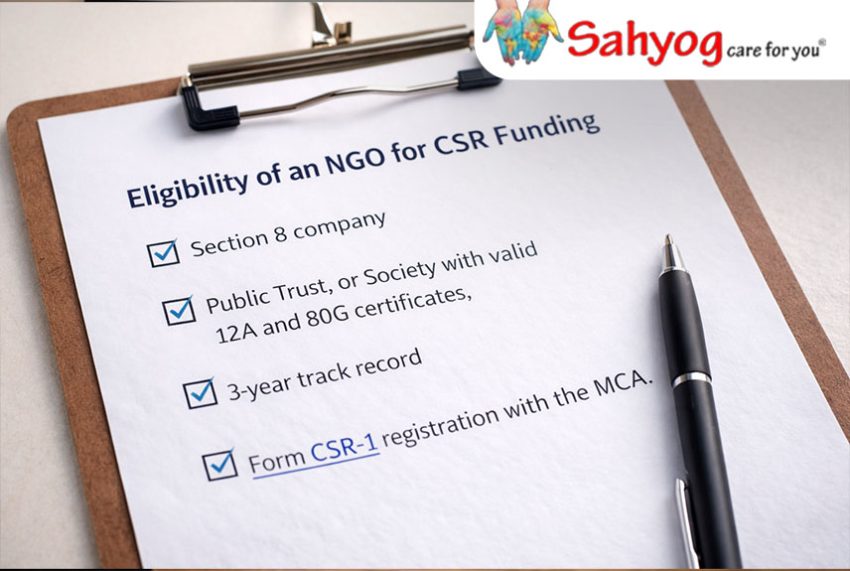

Section 135 of the Companies Act, 2013 governs the CSR spending in India. Companies should make sure their CSR donations are channeled to legitimate activities and agencies that are credible. Cooperation with an obedient NGO assists firms in fulfilling documentation and reporting requirements as mandated by corporate law.

An FCRA-approved NGO for CSR funding usually has well-organized systems of governance, audited financial statements and impact reports. This has eased the process of companies preparing CSR disclosures in their annual reports and also showing responsible use of funds.

Strengthening Long-Term Partnerships

Legal compliance builds a strong foundation for sustainable partnerships. The operational systems and the experienced teams of management of the NGOs tend to follow the FCRA norms. Such stability allows the companies to make long-term CSR projects without much uncertainty in the regulations.

Selecting an FCRA-approved NGO for CSR funding not only ensures lawful fund management but also enhances project credibility among stakeholders, investors, and communities. In today’s regulatory environment, due diligence is not optional it is essential.

Conlusion

The selection of an appropriate implementation partner is a key to the effective CSR initiatives. Adherence to the law secures both corporate donors and beneficiary communities. Through partnerships with an FCRA approved NGO for CSR funding, companies are assured of social causes funding without compromising any statutory requirement for the same, which is transparency, accountability, and long-term effectiveness.